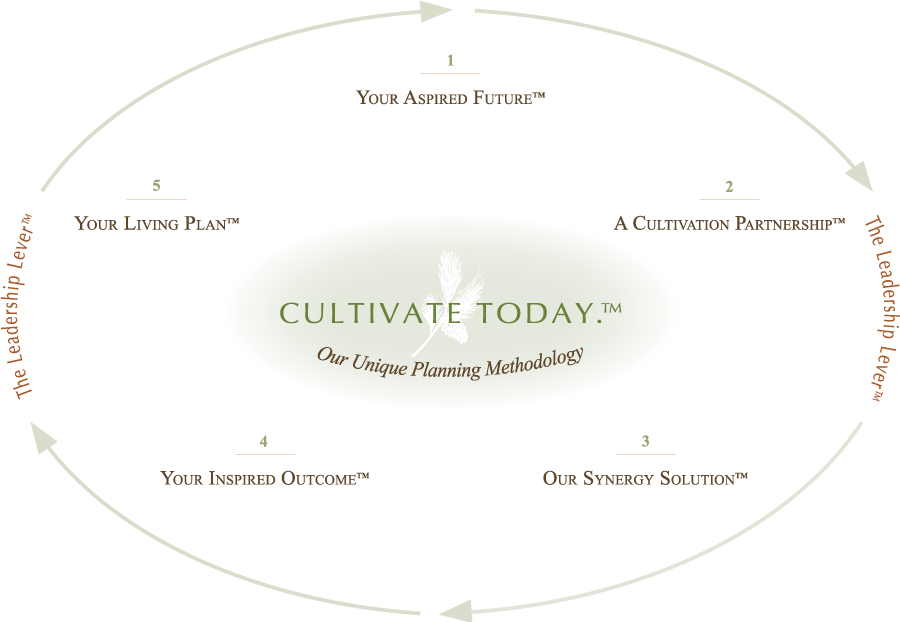

Cultivate Today: Our Unique Planning Methodology

Whether you come into our planning process as an individual, a family or a company, our Cultivate Today Methodology celebrates you as the central figure in your planning journey. This methodology inherently asks you to participate in the design of your future. Participation takes the mystery out of planning, allowing you to relax into the process.

When you’re invited to become highly engaged in the planning process, you’ll find yourself stepping more deeply into it. You’ll notice more acutely why you’re sitting at the planning table at all. The core context of your vision will naturally take form.

Instead of planning as something that’s presented at you or done to you, we create your plan together. For the first time, your planning is you. It’s your greatest potential in quantifiable, actionable form.

With our Cultivate Today Methodology, you’ll feel an unprecedented connection to your choices. It creates momentum to take your plan with you, your family or your company – living it consistently in the bright light of day.

Step 1: Your Aspired Future

When smart people seek help with their financial affairs, they often walk head-on into a wall of confusion. In search of confidence and clarity, you find that the process of choosing the right relationship is daunting.

When smart people seek out help with their financial affairs, they often walk head-on into a wall of confusion. In search of confidence and clarity, you find that the process of choosing the right relationship is daunting.

Step #1 provides an impetus to reflect on what you’ve achieved in life and wealth, and what you might wish to create for yourself and your family moving forward. Refreshingly, eighty percent of our conversations will be about you and your family, not your financial statements. We serve as your guide, posing thought provoking questions and helping you ease into the dialogue.

Longstanding clients often say this first step was incredibly cathartic. Most had no idea that planning could be so much about people; that who you are as a person – husband, wife, mother, father, parent, business owner or community leader – could actually drive the creation of your financial plan.

Step 2: A Cultivation Partnership

Once we’ve mutually decided to engage, we move into Step #2. In previous experiences, navigating your financial affairs may have felt ambiguous at best. In our process, the sample experience we’ve already had allows us to begin the journey with clear expectations and desired outcomes for our relationship. It creates momentum and even excitement for moving forward with your planning.

The sample experience we’ve already had allows us to begin the journey with clear expectations and desired outcomes for our relationship. It creates momentum and even excitement for moving forward with your planning.

Most busy, successful people don’t have all their critical documents, policies and statements in one place. In Step #2 we gather and organize all aspects of your financial life. Ours is a no-stone-unturned approach that reaches across all disciplines, such as: tax, legal, insurance, investments and business assets. We also identify your existing, longstanding Advisors who will be key players in our collaborative process.

As you push your stacks of paper across the table, you’ll find incredible relief in delegation. Finally, someone is accountable for helping you create a cohesive picture. Clients report feeling surprisingly engaged. The experience is fulfilling instead of hollow. You’ve become the central figure in your own planning. You begin to see that a financial plan has the power and potential to feel like an extension of your best self.

Step 3: Our Synergy Solution

At Cedar Brook, we like to say “it’s not about the questions you ask, it’s what you do with the answers.” In Step #3, we Cultivate Your Contributions from the two previous steps. We merge the emotional aspects of who you are, with the factual aspects of what you have. Using this combination of art and science, we create the first draft of your plan.

Life is dynamic and planning is multi-faceted; there typically isn’t one right answer. That’s why Cultivation Planning is part of our firm-wide DNA. In contrast to a lone-ranger model where individual Advisors work on individual plans, we believe it takes multiple minds to do justice to your planning.

We merge the emotional aspects of who you are with the factual aspects of what you have.Using this combination of art and science, we create the first draft of your plan.

That includes cross-pollinating the intellectual capital of multiple experts in our firm. First, depending on the family’s situation, there may be two or more Advisors working together on your plan. Second, because we have an established Planning Department, our planning process represents a distinct role supported by additional professionals.

We are your partner in helping to plan for and preserve your life’s work and we take this partnership seriously. Cultivating Your Contributions becomes a multiplier for a family’s most poignant solutions. It speaks to our firm-wide culture in which creativity is actively invited to incubate and grow.

Step 4: Your Inspired Outcome

As humans, we are skeptical by nature. In past planning experiences, perhaps you sat and listened to someone presenting recommendations. This dynamic can feel hollow, creating more questions than confidence.

When you have the opportunity to interact with your decisions and actually participate in the development of the plan,you’ll find yourself leaning into the planning process.

In Step #4, instead of the age-old approach of presenting a plan to you, we sit side-by-side and review your plan with you real-time on the big screen. For perhaps the first time, you will literally see how your goals and aspirations play out in numeric form. You’ll find yourself asking what-if questions about alternative choices and seeing the impact of these scenarios right before your eyes.

When you have the opportunity to interact with your decisions and actually participate in the development of the plan, you’ll find yourself leaning into the planning process.

Participation takes the mystery out of planning. Big decisions emerge naturally from the perspective of personal insight. Families understand what they’re choosing and why. Finally, planning is seamlessly integrated with life and no longer an external or foreign subject.

Step 5: Your Living Plan

In previous planning experiences, you may have reached the execution stage with a vague sense of relief but not necessarily clarity. In contrast, at this point in our process, you’ll feel like your plan is indeed your plan. You’ll find that your participation throughout the process catalyzes your commitment to living your plan from here forward. You’ll experience how empowering it is to participate in the design of your future instead of having someone present it to you.

We provide leadership and accountability, taking the burden of implementation off your shoulders as much as possible.

Coming out of Step #4 we’ll have a simple yet comprehensive Living Plan Summary and an Implementation Schedule. Because of all the great work we’ve done together up to this point, the implementation of your choices is refreshingly straight-forward. Also, our roles are extremely clear. We provide leadership and accountability, taking the burden of implementation off your shoulders as much as possible.

Unusual in the world of private, independent firms, Cedar Brook’s business model includes departments to manage all key functions. The Planning Department is staffed with project managers to support your Advisor’s implementation of your plan. We rely on time-tested processes with embedded workflows and checks and balances. In the background, Cedar Brook manages many core functions for your Advisor, such as technology, payroll and human resources. Without these distractions, your Advisor is free to focus on helping you live your plan in the real world.